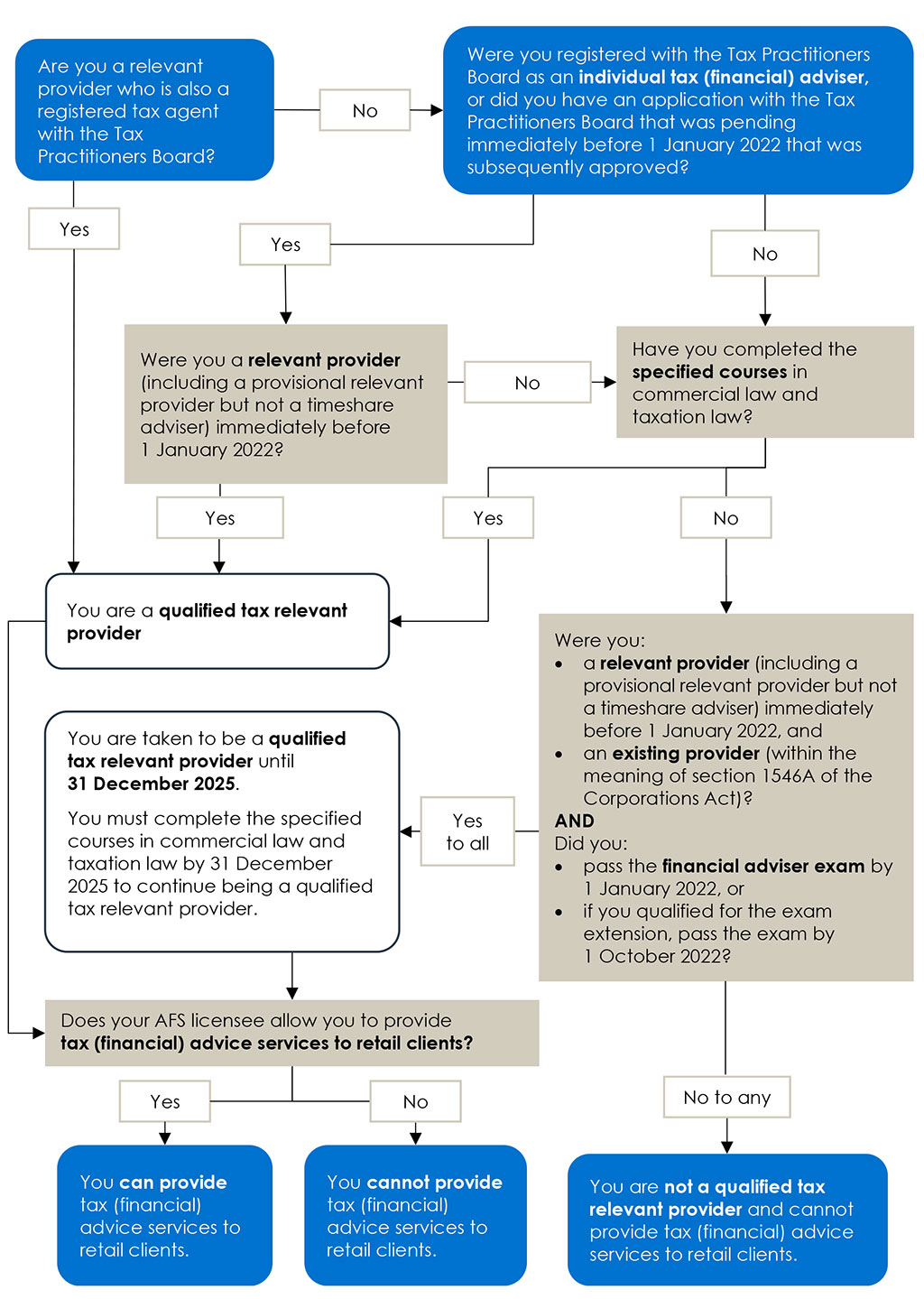

Flowchart: Can I provide tax (financial) advice services to retail clients as a relevant provider?

This flowchart should be read with Information Sheet 268 FAQs: Relevant providers who provide tax (financial) advice services (INFO 268). It sets out how to determine if you can provide tax (financial) advice services to retail clients as a relevant provider.

Flowchart: Can I provide tax (financial) advice services to retail clients as a relevant provider?

Note: See text version of flowchart process below which includes links to further information.

Text version – Flowchart: Can I provide tax (financial) advice services to retail clients as a relevant provider?

|

Step number |

Step information |

|

Step 1 |

Are you a relevant provider who is also a registered tax agent with the Tax Practitioners Board?

|

|

Step 2 |

Were you registered with the Tax Practitioners Board as an individual tax (financial) adviser immediately before 1 January 2022, or did you have an application with the Tax Practitioners Board that was pending immediately before 1 January 2022 that was subsequently approved?

|

|

Step 3 |

Were you a relevant provider (including a provisional relevant provider but not a timeshare adviser) immediately before 1 January 2022?

|

|

Step 4 |

Have you completed the specified courses in commercial law and taxation law? For more information, see INFO 268.

|

|

Step 5 |

You are a qualified tax relevant provider. Go to Step 9. |

|

Step 6 |

Were you:

AND Did you:

For more information, see INFO 260.

|

|

Step 7 |

You are not a qualified tax relevant provider and cannot provide tax (financial) advice services to retail clients. Flowchart path ends. |

|

Step 8 |

You are taken to be a qualified tax relevant provider until 31 December 2025. You must complete the specified courses in commercial law and taxation law by 31 December 2025 to continue being a qualified tax relevant provider. Go to Step 9. |

|

Step 9 |

Does your AFS licensee allow you to provide tax (financial) advice services to retail clients?

|

|

Step 10 |

You can provide tax (financial) advice services to retail clients. Flowchart path ends. |

|

Step 11 |

You cannot provide tax (financial) advice services to retail clients. Flowchart path ends. |