We penned an article a couple of weeks ago looking at how dairy EBIT margins since 1999 had been performing. You can find that article here. In it, we observed that margins were steadily increasing over time, moving from $2.00 to $2.50 per KgMS on a rolling ten-year average. Further, the analysis showed that at last year’s payout of $9.30, it was likely to have been our best ever margin (to date. Watch this space!)

Historical financial data is a significant part of the credit process – not just to measure how well a farmer has performed in the past, but also how they’re likely to respond under stress.

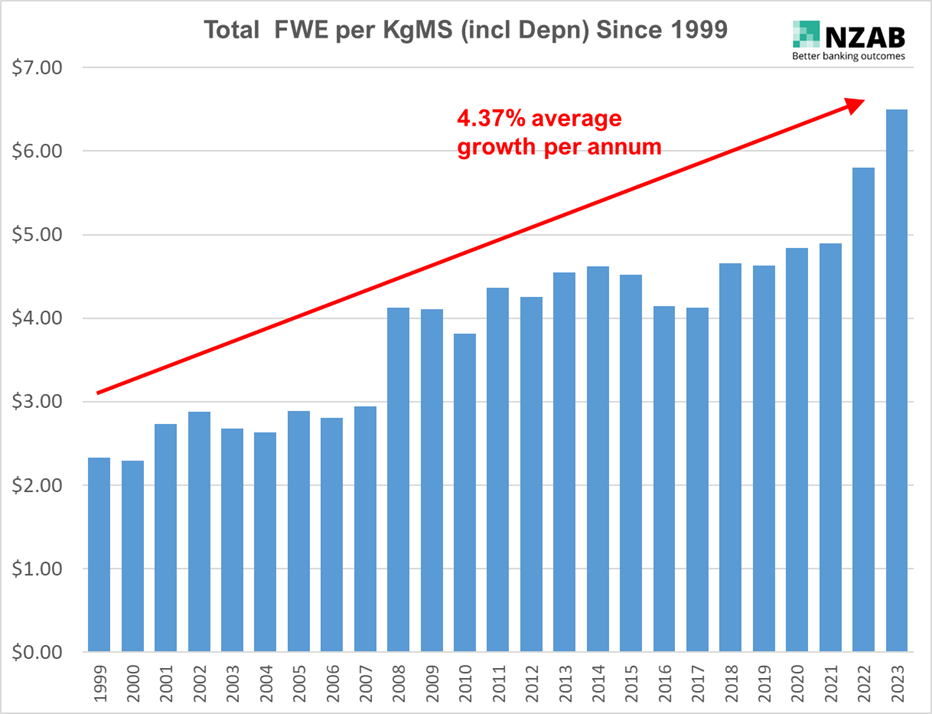

Overall, costs have been going up 4.37% on average, every year. That’s significantly above the rate of inflation during that period, estimated at 2.47% (CPI). Fortunately, dairy revenues have been increasing at a similar rate.

Interestingly, the latest step up in farm costs of 15% is not the largest we’ve seen since 1999. In 2007-2008, costs leaped a massive 40% - this was a structural shift at this point, ushering in a new regime of higher stocking rate and greater external feeding (feed and grazing moved from 20-25% of all costs to 30-35%).

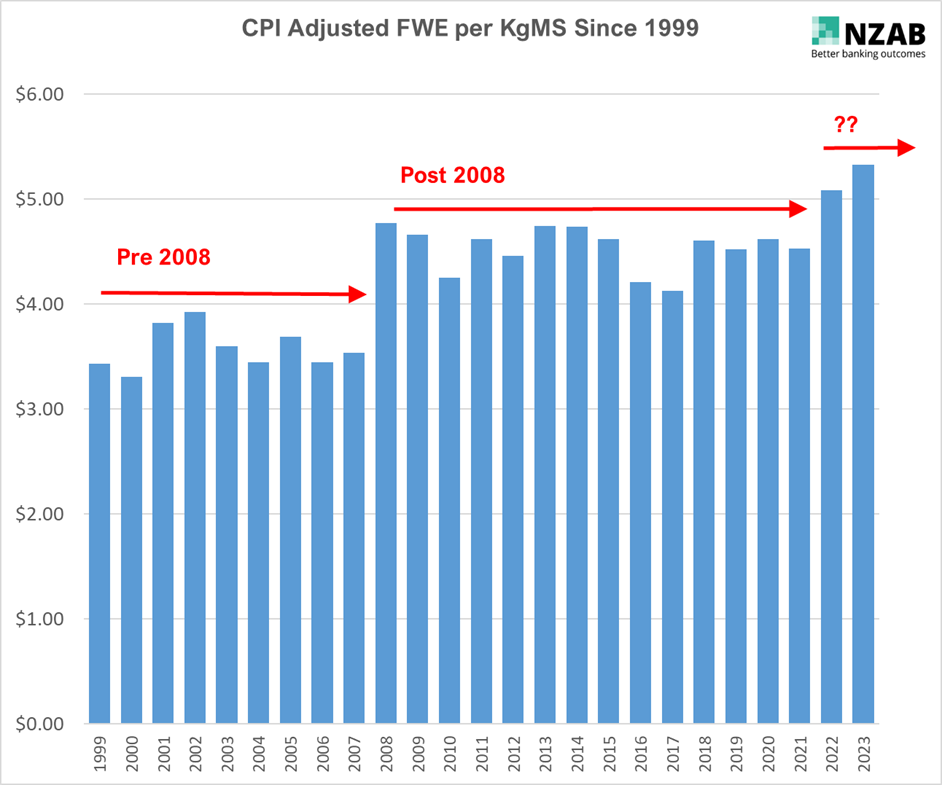

However, the data gets really interesting when we do adjust for CPI – see below:

Since 2008 (when we had a significant step up, post the first whole milk powder boom and that structural change in feeding), costs have actually stayed relatively flat, when adjusted for CPI.

The last two years represent a possible step up to a new plane, although it’s too early to say.

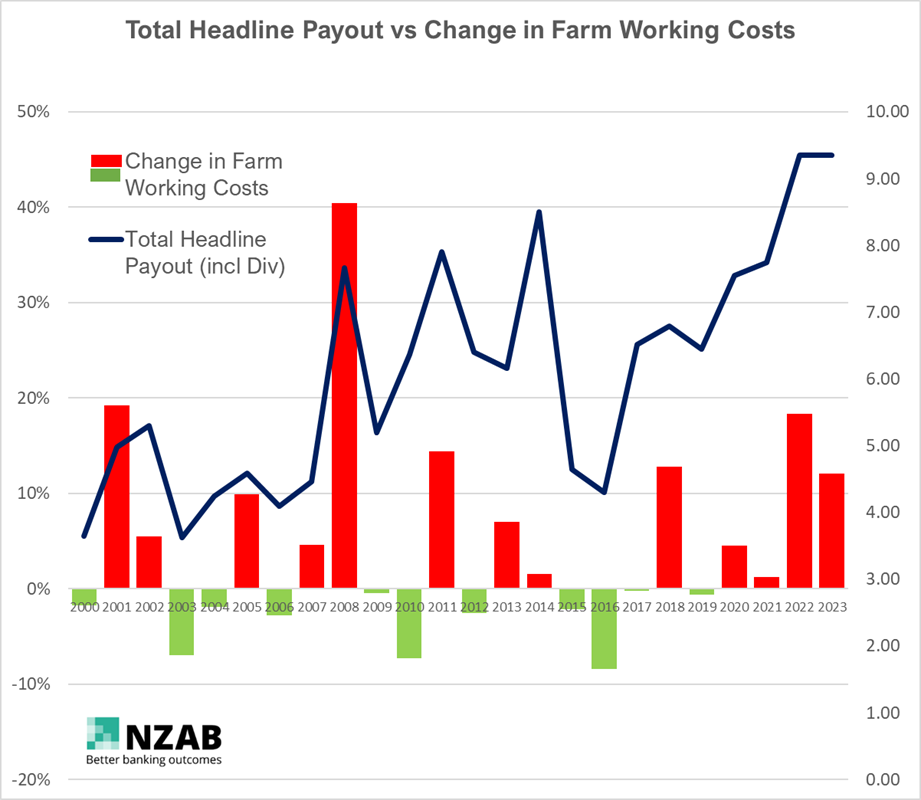

And how responsive are farmers to changing payout conditions?

To answer that, take a look at the graph below, plotting dairy payout versus the yearly change in farm working costs:

This is a significant piece of information.

There is clearly a strong correlation between change in payout (both up and down) and importantly, the ability for a farmer to change costs in response to protect margin.

In the 23 years since 1999, in 11 of them, farmers actually dropped their costs (without adjusting for inflation either). That is despite the general trend of farm costs being well above inflation.

The likely rationale for this elasticity is two-fold – one is that farmers are naturally very good at managing their costs to the economic situation of the time and secondly, there are some natural hedges that occur (for example lower world farm product prices may mean less demand for fertiliser leading to lower prices of that item and so on).

And why is this important?

Well, when farmers go through a credit process (for example, buying a new farm), we work with banks to show them how a farmer might perform when payout is lower, which is part of normal bank credit stress testing. This data (and having an individual farmers data alongside) shows that if a bank simply took today’s costs as part of that equation – the result is likely to significantly underestimate the farmers ability to respond and protect that margin.

And we think that might be useful when we help our farmers interact with their bank when going through their next credit process.

It might well be the difference between a yes… or a no.

Who is NZAB?

Farming’s very complex and you can’t be an expert in everything. That’s why the best farmers gather a specialist team around them. Our specialty is better banking outcomes for our clients.

There’s no one better to work alongside you and your bank. With a deep understanding of your operation and our considerable banking expertise, we can give you the confidence and control to do what you do best.

We’ve been operating for over five years now and we’re right across New Zealand, For an introductory no cost chat, pick up the phone and talk directly to one of our specialists on 0800 NZAB 12.

Or if you prefer, Visit us at our website or email us directly on info@nzab.co.nz