8 – 10 October 2024

Hamburg, Germany

8 – 10 October 2024

Hamburg, Germany

Managing risk - building resilience - unlocking opportunities 2024 will be a pivotal year for ports and their communities. Geopolitical instability is on the rise. Physical and digital security is under threat, at sea and on shore.

Shipowners, supply chain providers and cargo owners must adapt rapidly. The energy transition towards low- and zero-carbon fuels must be balanced against national energy security concerns.

ports – from developing and developed nations – are building secure and sustainable solutions to these shared challenges, in a deeply interconnected world.

©

For more information on attending, sponsoring or speaking contact the events team:

visit: worldportsconference.com

contact: +44 1329 825335 or email: wpc@mercatormedia.com

#IAPH2024

Silver sponsor: Bronze sponsors: Host sponsor:

2 Editor’s comment& contributors

Time to build communication resource

4 In conversation with Karin Orsel, President, ECSA Karin and Patrick Verhoeven, Managing Director, IAPH, discuss maritime sector priorities

8 Regional focus: Southeast Asia Opportunity knocks for the region’s container ports

11 Wake-Up Call

Southeast Asia, the longer-term view

12 One-to-One with ICTSI

Talking terminal business with an industry leader

17 Q&A with BMT

Collaborating with ports to close engineering gaps

18 The global economy

Performance and prospects analysed

22 Profile - Grimaldi Shipping, port and logistics innovator

24 The Column: Investment India about to emulate China strategy?

26 Pakistan port development Challenges remain despite positives

30 Energy transition

Preparing for offshore wind

32 Nine to Five: Richard Ballantyne OBE BPA’s charismatic leader charts a typical day

34 View from the stern Capt Norman Lopez FICS

Nearly 60 years at sea and navigating conflicts

36

40

Providing thought leadership on the role of ports in a connected world

EDITORIAL & CONTENT

Guest Editor: Mike Mundy mike@mikemundyassociates.co.uk

Features Editor: Felicity Landon

Publisher

Dr. Masahiko Fuirichi

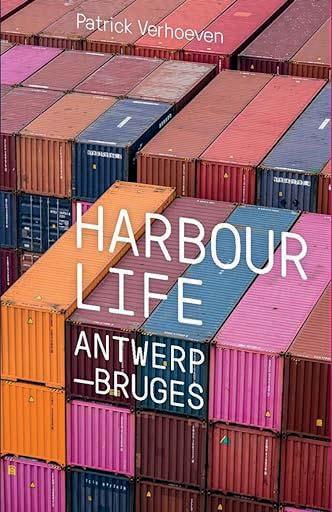

IAPH Secretary General info.verhoeven@iaphworldports.org

Dr. Patrick Verhoeven

IAPH Managing Director patrick.verhoeven@iaphworldports.org

Regular Correspondents: Felicity Landon; Ben Hackett Andrew Penfold; Vladislav Vorotnikov

Production David Blake, Paul Dunnington production@mercatormedia.com

SALES & MARKETING

t +44 1329 825335 f +44 1329 550192

Marketing marketing@mercatormedia.com

Chief Executive: Andrew Webster awebster@mercatormedia.com

Ports & Harbor magazine is produced and edited bi-monthly by Mercator Media Limited, Spinnaker House, Waterside Gardens, Fareham, Hants PO16 8SD UK

t +44 1329 825335 f +44 1329 550192 info@mercatormedia.com www.mercatormedia.com

Subscriptions INTERNATIONAL ASSOCIATION OF PORTS AND HARBORS

IAPH members enjoy a free subscription to P&H. If your organisation is not a member and you would like a paying subscription to the magazine, please contact the IAPH for more information at: 7th Floor, South Tower, New Pier Takeshiba

1-16-1 Kaigan, Minato-ku

Tokyo 105-0022, Japan

T: +81 (0) 3-5403-2770

F: +81 (0) 3-5403-7651

E: ph@iaphworldports.org

W: www.iaphworldports.org

©Mercator Media Limited 2024. ISSN 1740-2638 (print) ISSN 2633-4232 (online).

Ports & Harbor is a trade mark of Mercator Media Ltd. All rights reserved. No part of this magazine can be reproduced without the written consent of Mercator Media Ltd. Registered in England Company Number 2427909. Registered office: c/o Spinnaker House, Waterside Gardens, Fareham, Hampshire, PO16 8SD, UK.

MIKE MUNDY Guest Editor

MIKE MUNDY Guest Editor

Communication is key

The visibility of ports in the public eye and in terms of increased scrutiny by regulators and other government agencies has increased significantly. The pandemic and the associated congestion in supply chains effectively brought ports to the forefront of public attention and, even after the dissipation of the problems, has generally left this attention at a higher level.

The one-off event of the Evergreen vessel the Ever Given blocking the Suez Canal, which took place in March 2021 during the pandemic, served to consolidate and expand attention on the supply chain. It was an unprecedented event that caught the public imagination and one that in 6.5 days, the duration of the blockage, racked up economic damage to the global economy estimated to be in the order of €2 billion to €2.5 billion.

Russia’s invasion of Ukraine has also seen supply chain issues jump to the front pages of the world’s media, with ports very much part of this. The importance of ports being allowed to function effectively to serve vital grain exports has been and continues to be to the fore. When Russia invaded, in February 2022, its navy blockaded Ukraine's Black Sea ports, trapping 20 million of tonnes of grain meant for export. As a result, world food prices soared and threatened to create shortages in Middle Eastern and African countries, which typically import a lot of food from Ukraine.

A deal subsequently brokered by Turkey, in July 2022, provided some relief of this situation, with a safe corridor established facilitating grain exports. This ran for 310 nautical miles to and from the Ukranian ports of Odessa, Chornomorsk and Yuzhny/ Pivdennyi. While it lasted, this deal saw the export of nearly 33 million and a near 20% drop in world food prices. Russia chose to exit this arrangement almost a year on, but since then Ukraine has been quite successful in covertly moving grain across the Black Sea via a coastal route that maximises safety.

The end of the deal, however, also saw Russia launch a series of air attacks on Ukrainian ports. In turn, Ukraine has looked to utilise the Danube River as another route for grain exports and this too has attracted large scale attacks by Russia on port facilities, notably on ports near the Romanian border.

The war continues and with it the heightened profile of the role of ports in the supply chain.

There is also now the Israel-Gaza conflict, which has prompted serious attacks on

shipping by the Houthis, the Iran-aligned Yemeni group. Distressingly, these attacks against Red Sea shipping have recently caused the first fatalities of innocent seafarers.

Again, there is heightened attention on the supply chain, particularly concerning the disruption initially caused and the need to re-route vessels around the southern tip of Africa away from the danger zones. There has also been considerable media hype about the potential increased costs to business, retailers and the public in general.

The media spotlight continues to grow brighter.

Be prepared

What supply chain issues and the related media attention have taught us is that it is important to be fully prepared to respond to increased media attention. Ports are now much more on the radar than in pre-pandemic days, when there was less conflict in the world. The media management and public relations functions are commensurately much more important and, as such, worthy of increased resources to deal with this.

This is an important message for the decade ahead, where increased scrutiny promises to be the order of the day.

There are also other, more positive, drivers to take this course of action. The clean energy transition, for example, is not just an area of potentially massive new business engagement but again makes ports subject to greater public and formal attention.

Recent times have provided some important lessons in the communication sphere. It is vital that we learn from these. :

Award-winning journalist Felicity Landon is a well-known figure in maritime circles, with the depth of knowledge and network of contacts to prove it. Felicity is versatile in her areas of coverage, with these spanning the container, dry and liquid bulk, cargo handling, energy and diverse other subject areas. In this issue, a highlight is her In Conversation piece with Karin Orsel, the first female President of the European Community Shipowners Association (ECSA) and Patrick Verhoeven, Managing Director, IAPH. :

Vlad Vorotnikov is an international journalist specialising in coverage of the energy, agriculture and transport services markets. He holds a master’s degree in journalism and specialises in covering Eastern Europe and Asia. Based in Georgia, he has been contributing to Ports & Harbours since 2018. In this issue, Vlad takes an in-depth look at investment activity in Pakistan’s port industry, recent and foreseeable, and charts future prospects and areas of challenge. :

BEN HACKETT Consultant editor

BEN HACKETT Consultant editor

Ben Hackett brings more than 35 years of experience in liner shipping, ports, international economics, trade and transportation planning as well as in-depth knowledge of the industry to his editorial commentary. In this issue, he addresses in depth near-time global economic prospects and assesses the potential ramifications of this for liner shipping and ports. :

ORSEL

ORSEL

Karin Orsel, the first female President of the European Community Shipowners’ Association (ECSA), and IAPH Managing Director Patrick Verhoeven (former Secretary-General of ECSA) discuss the importance of resilience, adaptability, inclusion and diversity, as the maritime industry faces immense challenges ahead

It's not unusual for maritime leaders to wear several hats – the breadth of experience they bring to their roles is of clear value. Karin Orsel is no exception, although perhaps she has even more hats than most. The owner and CEO of MF Shipping Group, which she founded 30 years ago, Karin is a board member of the International Chamber of Shipping, board member of the Royal Dutch Shipowners’ Association (KVNR), Chair of the International Seafarers Welfare Assistance Network (ISWAN), and an Ambassador and Past President of the Women's International Shipping & Trading Association (WISTA) – to name but a few.

Recently appointed President of ECSA, Karin says her various roles certainly help her to build a broad picture of the industry with various viewpoints. “My extensive experience in the maritime industry, at company, national, European and global level, provides me with a unique opportunity to approach challenges from different perspectives,” she says. “I am highly motivated to promote excellent working conditions for seafarers and to broaden the talent pool for our industry by focusing on diversity and inclusion. These are two areas where I want to raise standards for the industry. Although we already have good standards, I believe there is always room for improvement and we can raise the bar a little higher.”

Becoming the first female President in ECSA’s history is ‘a momentous occasion’, says Karin – signalling the positive progress we are making towards greater diversity and inclusion in the maritime industry. “I firmly believe that diversity brings fresh perspectives and innovative ideas to the table.”

Considering her goals for the coming two years, she notes that navigating the complexities of the post-pandemic recovery and geopolitical unrest has been a challenge for the shipping sector. “With the climate crisis in the backdrop and the introduction of

the most ambitious climate package internationally, ECSA has faced a lot of challenges over the past four years. However, the organisation has managed to come out stronger and become the focal point of the shipping industry in Brussels.”

IAPH Managing Director Patrick Verhoeven, who was ECSA’s Secretary-General from 2013 to 2017, agrees. “The shipping lobby has made a huge leap forward in recent years, including at the international level of ICS, especially on topics such as decarbonisation,” he says. “In my day, there were still a considerable amount of national shipowner associations who were in denial about the carbon footprint of the industry. Today this is very different, and it is great to see how ICS is now able to play a very proactive role at the IMO, with ECSA doing the same in Brussels.”

Throughout the unprecedented challenges of Covid-19 and associated disruptions, and increasing geopolitical instability, shipping has remained resilient and adaptable, says Karin. “In fact, it has become increasingly clear that shipping is the cornerstone of European security, from energy to food to supply chain security. Shipping also plays a strategic role in achieving Europe’s climate objectives, towards the Fit for 55 target by 2030 and the Net Zero target by 2050. It is key for Europe to support shipping as a strategic sector, but this needs to be balanced against the need to ensure open access to markets, avoiding a protectionist approach.”

Resilience has also become a key theme for IAPH. “The pandemic brought this topic to the forefront of our agenda,” says Patrick. “We started out with a Covid-19 Taskforce which met on a weekly basis to track the worldwide impact of the pandemic on port business. We quickly transformed it into a permanent technical committee, and this has been very useful as we have been moving from crisis to crisis since, with the Red Sea attacks being the latest unfortunate episode. Our committee produced a series of concrete guidelines that help ports deal with

unpredictable disruptions and strengthen their resilience as critical infrastructures.”

He adds: “The recent crises have also brought the maritime industry closer together and there is now a permanent dialogue between IAPH, ICS and other stakeholder organisations.”

ECSA has welcomed the objectives of Fit for 55 and worked closely with the EC to achieve workable solutions for the shipping industry in its discussions around the EU Emissions Trading System (ETS) and FuelEU regulations, to ensure that these measures deliver on their decarbonisation goals, says Karin. However, we should not forget that shipping is a global sector that needs global regulation, she adds. “This is key to ensure that European shipping operates on a level playing field internationally. In its recent Communication on the EU 2040 climate target, the Commission considers differentiated targets for shipping in alignment with the IMO GHG Strategy, under the three scenarios for the decarbonisation of the European economy. We believe this is a strong message of support to the IMO to develop the measures necessary to reach Net Zero GHG emissions from international shipping by 2050.”

Cooperation between shipping and ports is paramount when facing challenges such as decarbonisation and digitalisation –indeed, these challenges create opportunities for increased cooperation, notes Karin. “We cannot work without each other. The infrastructure for new fuels is an example. Ports will play an increasingly important role in delivering new fuels and the dedicated bunkering infrastructure for the green transition. In this regard, ECSA and the European Sea Ports Organisation (ESPO) cooperated closely to push for the earmarking of the revenues of the EU ETS for transfer back to the maritime sector, and we are in dialogue with the Commission and other stakeholders to best use these revenues under the EU Innovation Fund.”

It is key for Europe to support shipping as a strategic sector, but this needs to be balanced against the need to ensure open access to markets, avoiding a protectionist approach

KARIN ORSEL, President, European Community Shipowners’ Association (ECSA)

Although it is understandable why the EU wants to press ahead with the inclusion of shipping in its Emissions Trading System, Patrick has serious doubts about its effectiveness, given also the negative impacts it will have on port trade. “The proposal was already on the table when I was at ECSA and I recall that European ports did not share the concerns of shipowners back then and were even openly lobbying in favour of the inclusion of shipping,” he says. “Now it appears that these concerns were legitimate and that the risk of diversion of traffic away from EU ports as a result of the scheme is real.

"All eyes now are on the IMO, which is expected to set the framework for its own market-based measure in the coming year. I sincerely hope that the EU will then withdraw its scheme and align with the global market based measure (MBM), which is more likely to take the shape of a carbon levy.” IAPH is arguing in favour of a scheme that will earmark revenues collected from an international shipping MBM to port infrastructure projects in Least Developed Countries and Small Island Developing States, including investments that will protect these ports from the effects of climate change and enable them to play a role as energy hubs.

The importance of a ‘people-centred’ energy transition and the need for upskilling and reskilling of seafarers are essentials highlighted by Karin.

“Shortage of skilled labour is a societal and economic challenge. It is striking that 77% of EU companies struggle to find workers with the necessary skills,” she says. “This is even more pronounced in the maritime sector, where shortage of skilled labour is a significant problem, in particular for more technical functions, such as ratings and engineers. The green transition brings additional challenges, as future fuel technologies such as hydrogen, ammonia, batteries and biofuels, to name a few, require new skills, education and operational training for seafarers. Studies show that as many as 800,000 seafarers will require carbon upskilling by the mid-2030s. I believe that a people-centred

Karin was only 23 when she ‘took the plunge’ and set up MF Shipping Group in 1994. Today it manages 55 vesselstransition is important across the whole maritime sector. For example, low and zero-carbon fuels on board ships have different technical characteristics to the current marine fuels and come with safety implications requiring training and reskilling of both seafarers and port employees.

The influx of talent in the port industry is also a concern for IAPH. “We have started a discussion internally of what we can do to attract tech-savvy people to our sector to ensure future generations of workers. This includes people with a nautical background, who are much needed in many shore-based professions, such as harbour masters, maritime pilots and others,” says Patrick.

Is there always a tension between shipping lines and port/ terminal operators? Karin would argue that there is always room for improvement on both sides. “We look forward to our continued cooperation with the port organisations. Ports are the engines of the economy and major enablers of open trade. We need to work together so that paperwork is reduced and operations become more digitalised, to save time and make trade more efficient. We’ve got a big exercise at European level with the European Maritime Single Window environment that aims to streamline the submission of data requested by ports and competent authorities. We should work even harder to optimise port calls so that ships do not wait for days to enter the ports.”

Patrick couldn’t agree more. “Port call optimisation is a no-brainer, but it is still far from being widespread practice. A lot of good work has been done by the International Task Force Port Call Optimisation in mapping out port call processes and advocating international standards, but we need to start using them worldwide.”

Karin was only 23 when she ‘took the plunge’ and set up MF Shipping Group in 1994. “I had the opportunity to take over a bankrupt company where I was working. Starting with a modest fleet of six vessels and a team of 50 crew members onboard and just three people in the office, my adventure began,” she says.

Today, MF Shipping Group manages a fleet of 55 vessels with approximately 1,250 crew members on board and a further 80 employees in its office in the Netherlands. “Our fleet includes a diverse range of vessels, from product and chemical tankers to multipurpose vessels, self-unloaders, cement carriers and a roll-on/roll-off vessel. We are recognised as a leading ship management company in the tanker segment.

“During those times, I was fortunate to have the right people around me for valuable advice and support – people who believed in me. This experience taught me the importance of trust and accepting support. In my work, I share my experience, network and knowledge in the belief that if everyone helps a few people in some way, it will create a positive chain reaction.”

One of the first lessons she learned from her own experience is the importance of staying authentic and true to yourself. “By doing so, you not only build a trustworthy reputation, but also inspire others to do the same. I have been able to sustain these 30 years by staying true to myself, and it is still about trusting and surrounding yourself with the right people. Success is a team effort.”

MF Shipping Group strives for diversity and inclusion at various levels within the organisation, including roles that are

‘‘

A lot of good work has been done by the International Task Force Port Call Optimisation in mapping out port call processes and advocating international standards, but we need to start using them worldwidePATRICK VERHOEVEN, Managing Director of IAPH

traditionally considered ‘male dominated’ such as technical superintendent, and vice versa. Diversity goes beyond gender, she emphasises. “We work with 21 different nationalities on board and 11 different nationalities in the office. We work to create an inclusive work environment where individuals, regardless of gender, age, sexual orientation, religion or other characteristics, can thrive and contribute to the maritime industry.

“Diversity in the maritime workforce is not just a matter of equality; it is a strategic imperative that brings a wealth of benefits to the industry. Both women and men bring unique perspectives, skills and insights that drive innovation and improve overall performance.”

Addressing the barriers for women in the maritime sector requires a multifaceted approach, she notes. “This includes reducing gender bias, providing adequate onboard facilities such as sanitation and appropriate clothing, implementing mentoring programmes and offering opportunities to promote work-life balance. Educational initiatives such as outreach programmes and scholarships can play a crucial role in encouraging young women to pursue studies and careers in maritime-related fields.

“Encouraging more women to pursue maritime careers is crucial to unlocking untapped talent and ensuring a dynamic and forward-looking industry. To attract more women to maritime careers, it is essential to break down existing stereotypes and showcase diverse role models. Highlighting success stories, such as my own story of starting my own business as a shipping manager at the age of 23, can inspire women to consider the maritime sector as a dynamic career path.”

Patrick concurs that there is a need to encourage greater diversity and foster new types of leadership in the maritime sector. “The latter is especially an issue for port authorities, which are moving from traditional ‘landlords’ to more entrepreneurial business developers, and this obviously requires a different managerial skillset. This partially links to the World Bank’s upcoming new edition of the ‘Port Reform Toolkit’, to which we contributed as IAPH, and I hope we can announce a concrete initiative on the future of work in ports later this year.” :

With the economy in China potentially faltering, what are ports in Southeast Asia doing to take advantage of the shift in manufacturing activity to their region?

s China still the unstoppable economic force and manufacturing engine room for the world? Well, it is becoming apparent that a combination of economic challenges, following Beijing’s hard-line COVID-19 approach to completely shut-down port cities, continues to raise questions about the country’s future trading position.

IThere has been a negative impact on the supply chain for goods out of China, with the container industry of shipping lines, beneficial cargo owners and ports receiving the Chinese export loads, being negatively impacted. Unsurprisingly, manufacturing has continued to move to other locations, ostensibly to Southeast Asia, as well as India in South Asia.

Countries in the the South East region are highlighted in Figure 1, and this review assesses major container ports in this area.

The region’s transshipment hub ports are highly established and this is reflected in the volumes handled (Figure 2).

Singapore has long been one of the largest, or the largest, container volume ports globally, reflective of its current activity of over 39 million TEU per annum, while both Port Klang (14.06

million TEU in 2023) and Tanjung Pelepas (10.48 million TEU per annum) also, unsurprisingly, handle higher volumes than all gateway facilities.

Nevertheless, there are substantial container volumes, and continued year-on-year growth, moving through many gateway ports in the Southeast Asia region (Figure 3). This is true in Vietnam, which is a country that continues to seek manufacturing growth, including encouraging a switch from China.

There has been continued growth at major container ports, such as Haiphong in the north, handling an estimated 5.70 million TEU in 2023 and reflecting growth of 7.3 per cent per annum in the period since 2010. Likewise, in the south is Ho Chi Minh City, which saw an estimated eight million TEU in 2023, annual growth of 5.1 per cent since 2010.

VietnamCredit recently stated that it expects Vietnam’s container port traffic to increase by 8.6 per cent per annum

during the period 2022-2030, meaning that there is a continued need for more investment in infrastructure and equipment.

In response to the expansion of container port capacity, the government in Vietnam is focusing on developing the quality of facilities at both Hai Phong and Cai Mep ports to what it classifies as “international standards.”

Mediterranean Shipping Co (MSC), with the Vietnam Maritime Corporation, is developing a massive new container terminal near Ho Chi Minh City, which is looking to invest US$6bn over an 18-year period.

The aim is to build a new terminal on a 1,400-acre site, with an annual capacity of up to 15 million TEU per annum and able to support ships up to 24,000 TEU in size.

Interestingly, the facility is anticipating 80 per cent of its volume to be international cargo and the remaining 20 per cent serving domestic demand.

The terminal is slated to be operational in 2027 and then develop in seven phases by 2040 and follows recent port developments by both Maersk Line and CMA CGM in the region.

Thailand’s eastern focus

Thailand’s maritime freight industry continues to build steadily, with over 90 per cent of goods imported to and exported from the country moving by sea. The country has signed a range of agreements on economic cooperation that aim to increase trade and investment flows, notably amongst the ASEAN Economic Community (AEC).

Around 70 per cent of Laem Chabang container port volumes involve Intra-Asian trade, with links to China of importance. Despite a minor drop in 2023 to 8.68 million TEU, down slightly on the 2022 figure of 8.73 million TEU, this port has recorded

increases of four per cent per annum between 2010 and 2023.

Despite previous weak global demand, for Q3 and Q4 of last year the national government reported “good shipment” demand because of positive year-end orders, with confirmation of a “cycle where there will be a lot of orders" .

Improvements in Laem Chabang continue to occur at the expense of Bangkok, which has seen its 2010 total container port throughput of 1.50 million TEU fall to around a 1.30 million TEU annually.

This position is not expected to change because port development continues to be focussed in Laem Chabang, which

is currently working through a US$927 million expansion that will see the existing stated capacity of 11 million TEU per annum increase to 18 million TEU per annum by 2029.

This expansion is linked to the country’s growth plans for its Eastern Economic Corridor (EEC), which is targeting the development of Thailand’s eastern seaboard into a hub for high-tech industries, including medical services, biotechnology, biofuels, automation/robotics, aviation, digital technologies and smart electronics. Automotive is already a vital cog to the national economy, accounting for 10 per cent of national GDP.

Currently, approximately 88 per cent of transport from the port is via the road system and 9.5 per cent by rail. A new freight rail hub will increase the handling capacity for rail transport from 500,000 TEU per year to two million TEU per year. This will increase the proportion of container traffic moved by rail to 30 per cent.

Manila in the Philippines is another of the very largest container ports in Southeast Asia. In 2023, the port handled an estimated 5.21 million TEU, which confirms growth of 3.7 per cent per annum since 2010, when 3.26 million TEU passed through its facilities.

International Container Terminal Services Incorporated (ICTSI) has commenced work on the expansion of the Manila International Container Terminal (MICT). The construction of the new Berth 8 will be carried out in two phases and will allow MICT to handle extra volumes, while accommodating nextgeneration container ships of up to 18,000 TEU, to complement its existing capacity of three million TEU per annum.

The new Berth 8 will add 400m of quay and up to 12ha on the landside, with a dredged depth of 13.5m, with the possibility of further dredging to a depth of 15m.

SIHANOUKVILLE

YANGON

TANJUNG PERAK (SURABAYA)

TANJUNG PRIOK

(JAKARTA)

BELAWAN

JOHOR

PENANG

CEBU

MANILA

BANGKOK

LAEM CHABANG

CAT LAI (HO CHI MINH)

MICT remains a key facilitator of trade for the Philippines, complemented by ICTSI’s network of marine and inland terminals across Luzon, the Visayas, and Mindanao.

At the same time, Asian Terminals, Inc. (ATI) is increasing the Manila South Harbor’s annual capacity to nearly two million TEU per annum capacity, up from 1.5 million TEU per annum. The construction of Pier 3 adds five new yard cranes and two ship-to-shore (STS) container cranes.

New Priok Port for Indonesia

Indonesia’s largest volume container port, Tanjung Priok, handled an estimated 6.5 million TEU in 2023, which reflects growth of 2.5 per cent per annum in the period since 2010. This is down on the decade-high 2018 figure of 7.64 million TEU, although this resulted in substantial congestion with the port reportedly only designed to offer a capacity of five million TEU per annum.

Consequently, it is unsurprising that there are plans to increase container-handling capabilities, through the ongoing project for New Priok Port (also known as Kalibaru Port) on a 195-acre site in North Jakarta.

When completed, the new facility will enable Tanjung Priok to increase its annual capacity to 18 million TEU per annum, with the ability to facilitate ships of up to 18,000 TEU+.

Ports in Southeast Asia continue to see increases in container volumes handled but the shift of manufacturing from China means a need for more terminal capacity. It needs to be delivered because the ability for manufacturing to shift to India also remains a competitive threat. Indicative of this trend: the port of Tuticorin has just issued tenders for two new high-capacity container terminals in the port’s outer harbour offering an eventual total throughput capacity of 4 million TEU. :

ANDREW PENFOLD Independent Maritime Economist

ANDREW PENFOLD Independent Maritime Economist

Andrew Penfold does some ‘crystal ball gazing’ on the longer term outlook for Southeast Asia

It’s clear that the Southeast Asia region is highly dynamic, but this has been driven by Chinese exports and the integration of regional industry by means of Chinese investment. This model now looks, at best, broken and far-reaching changes seem certain to reshape the port sector. China’s problems are well known: slower growth, a declining population and deepening concerns over regional political instability (Taiwan and other issues).

China’s unprecedented expansion has been driven primarily by low labour costs. This advantage is also declining, which is forcing international investors to look for alternatives, with this already modifying supply chains. There are plenty of alternatives to China in the region which offer cost advantages without the baggage of geopolitical threat. Realising these opportunities will require further large-scale port investment.

At present, major investments from international companies are focusing on nearshoring (the recent surpassing of China by Mexico as the US’s primary import source is a good example of this). However, it seems more likely that the focus will shift to lower cost ASEAN and Indian suppliers at the expense of China. The rapid pace at which China developed underlines the speed at which these changes could take place. The current hollowing out of Hong Kong provides a potential model of what could happen more broadly in China.

In ten years’ time?

If we discount the unmeasurable impact of any major geopolitical upset, then an extrapolation of these trends gives an indication of how the markets will develop. At present (as A J Keyes explains in the preceding article, Opportunity Knocks) investment is proceeding strongly

in the region – although this (largely) represents a piecemeal expansion of major existing projects. Currently, the level of demand in most instances is insufficient to justify Megamax-capable port development. So, although demand is highly dynamic this indicates a general expansion of current operations. Looking ahead it seems that a phased development is the most likely outcome.

Initially, ship size limitations – together with a reliance on smaller ports – will see a further expansion in the feedering and transshipment model. This will directly benefit the major regional transshipment hubs –Singapore, Port of Tanjung Pelepas, Port Klang, etc. –where demand is set to accelerate further. The focus here will be on the Europe trades. Other ports will also see transshipment volumes increase for Transpacific operations, but this will be superimposed on direct export flows. It seems certain that this pattern will drive the market at least for the next five years.

After this, with volume accelerating further, the emphasis will switch to the provision of truly deepwater capacity allowing the direct handling of the largest container vessels. This will generate a new round of (commercial) investments in ASEAN ports and also in India.

This process of maturation of the market has already been underway for some time, but the real catalyst for development will be worsening uncertainties with regard to the role of China in the trades. These developments could happen quickly, and close attention must be paid to the development of inward manufacturing investment in the smaller regional economies and the consequent need for infrastructure funding. :

The world of terminal operations continues to evolve at a rapid pace.

Ports & Harbors talks with a leading global operator about contemporary challenges and what it takes to succeed in a highly competitive sector

MIKE MUNDYPorts & Harbors sat down with Christian Martin R. Gonzalez, Executive Vice President, International Container Terminal Services inc. (ICTSI), to discuss what constitutes a modern-day international terminal operator, what are the prevailing areas of challenge and how does ICTSI separate itself from the crowd when it comes to providing terminal operating expertise for a landlord port authority?

His first point he sees as an important one and one that has not yet fully registered with many port authority managers. “The structure of the terminal operating industry has changed a lot over the last 10 years. There are now more categories of terminal operator than have existed previously with distinct differences between them which

has implications for port authorities seeking a strong investor/good operator. As an example, there are more government-owned and controlled operators today, some of which are now targeting much longer concessions often via government-to-government deals on an exclusive basis. Similarly, while shipping lines have traditionally been players in the sector with the increased emphasis by many on transitioning to fully-fledged logistics providers. This means that terminal operating units can increasingly play the role of cost centre (not profit centre) supporting the core freight transport business.”

This is evolution Gonzalez acknowledges but it can also be distorting. Port authorities can be enticed under government-togovernment deals by both big sums of money and all sorts of add-ons. Equally, with shipping lines there is the attraction of volume but this, in reality, can be a honey trap as it is not accompanied by strong earnings characteristics.

Where does ICTSI sit in this context?

“Where we always have, underlines Gonzalez, we pride ourselves on our independence, offering a level playing field of competitive services to all our shipping line and other clients” – Table 2. “We also firmly believe that terminal concessions are best awarded via a competitive, fully transparent, tender process. We see the multi-criteria bid

Headquarters: Manila, Philippines

Regional Offices: Manila (AsiaOceania), Dubai (Europe – Middle East – Africa), Panama: The Americas

Founded: 1987

Terminals: 32

Market Capitalisation: US$ 10 billion

– comprising a technical and financial submission – as having a proven track record, which properly administered, can deliver the best result for all concerned; host port authority, terminal operator and the terminal’s clients and stakeholders in general.”

How does ICTSI view Master Port Concessions, where the whole port is privatised? “I have to say we are still learning,” states Gonzelez. “Our fully automated terminal in Melbourne, Victoria International Container Terminal, is now hosted by such an entity and we have endeavoured to embrace the wider powers of the privatised Melbourne Port Corp (MPC) by placing a submission with them for the next phase of development at Webb Dock, but we have not yet seen any take up in this respect. We believe our proposition is unique in terms of the inherent scale economies and levels of efficiency that it offers. We remain open to engaging with MPC on this.”

Gonzalez perhaps hits upon one of the ironies of so-called Master Port Privatisations in that the take-up for these has largely been by financial entities, private equity and so on, and that they are, comparatively speaking, new to the sector and tend to tread carefully not wishing to upset the host regional or central government. There is perhaps a case for them to be bolder to achieve more.

Cost containment is an area of ongoing attention, as might be expected. “As you would expect we have a strong focus on this,” says Gonzelez. “Where capital projects are concerned, we budget carefully, the emphasis being on avoiding costly over-runs and maximising return on investment. In terms of operating cost, we see certain

‘‘

We pride ourselves on our independence, offering a level playing field of competitive services to all our shipping line and other clients…

CHRISTIAN MARTIN R. GONZALEZ, Executive Vice President, ICTSI

service areas as spiking to levels beyond what we consider to be acceptable, notably the IT side of things when paying on a per move basis. But this is not just our issue and as such we expect a market correction.”

At a broader level, it evident that ICTSI is not afraid to take risk as is exemplified by its 33 strong terminal portfolio with many of these business units sitting in emerging or developing markets which are recognised as having a greater level of challenge. “We are

good in these markets,” underlines Gonzalez, “we have considerable experience and our track record speaks for itself with many successes under our belt.” He adds: “we were recently awarded the concession for Durban Container Terminal Pier 2 (DCT2) where we will work together with Transnet to boost efficiency levels across the board. We look forward to working with them and building a highly productive partnership.”

Also, on the subject of risk, it is known

Independence We value our independence as a great asset which enables us to treat all liner and other clients even handedly.

Ultra Diverse

from ICTSI’s current investment activity that it is not afraid to invest over and above the requirements of any concession agreement, subject to identifying the usual business positives for doing so.

ICTSI is presently developing Berth 8 at its flagship Manila terminal which will cater for increased demand but importantly also allow vessels of up to 18,000TEU capacity to be handled. In this context, Gonzalez has previously explained: “ICTSI is not specifically obligated under its contract with the Philippine Ports Authority to build Berth 8. We’re doing it to become more competitive….our commitment has always been to provide the highest levels of service and infrastructure, and building another berth to increase our terminal’s capability is one way of honouring that commitment.”

What makes ICTSI successful?

ICTSI has turned in some impressive results recently compared to its peers in terms of profit margin on turnover and yield per TEU handled. When asked by P&H what makes ICTSI the best in the sector, he points to the Group’s recent financial performance as a barometer of this and similarly the range of blue-chip investors in ICTSI, many headquartered in the USA and Europe. But it is just not one thing which has propelled ICTSI forward and which gives it strong credentials as an investor and operator – Gonzalez cites a menu of key factors which he summarises in Table 2 and which makes interesting reading. :

This is reflected in our terminal portfolio which spans mature, developing and emerging economies and is reflected in our operating expertise, which extends right across from one of the world’s most successful fully automated container terminals, active in Melbourne, Australia, through to multipurpose facilities.

Our ability to adapt to local requirements, partner and client needs is reflected throughout our terminal portfolio which also reflects our diversity in a development context spanning terminals developed on a Build Operate Transfer basis, acquired as a walk-in concession or in some cases on a full ownership basis.

Sustainability Sustainability is at the core of what we do at ICTSI, and our underpinning principle of Good Global Citizenship guides our relationships and actions. ICTSI’s sustainability initiatives serve as both our compass and ballast and enable us to evaluate our performance against our targets for social, environment and economic impact.

Management We maintain a slim but highly effective management team. Collectively, the Executive Management team possesses a wealth of experience drawn from along the supply chain –shipping, freight transport, port management and the terminal sector as well as other supporting specialist disciplines.

Workforce

Digitally Empowered

ICTSI empowers its workforce with training, including IT supported training, and permanence in traditionally difficult environments. Progressively, we are creating digitally driven jobs in markets where these did not exist before, up-skilling our employees and facilitating upward mobility in the workforce structure.

The company harnesses new digital technology to help build service capability and levels. Equally, there is a strong focus on empowering port users to make better, more timely business decisions with new digital tools such as the ICTSI App which gives port users real-time access to critical logistics data across ICTSI’s global operations.

Investment Friendly Building stakeholder value is a catalyst to our day-to-day activities and drive for progress.

APRIL Port of Amsterdam

The Netherlands

Delegate place includes 2-day conference attendance including lunch & refreshments

Technical Visit

Electronic documentation

Hosted by:

Sponsors:

Supporters:

Short Sea Shipping -

Advancing supply chain resilience with modal shift

Smart operations - Digitalisation, Automation, & Innovation

• Green corridors - collaboration to drive sustainable growth

Gold Sponsor

Coastlink is a neutral pan-European network dedicated to the promotion of short sea shipping and lines, ports, logistics companies, terminal operators, cargo handlers, and freight organisations.

For more information on attending, sponsoring or speaking contact the events team: visit: coastlink.co.uk

contact: +44 1329 825335 or email: info@coastlink.co.uk

Media partners:

GREENPORT

Ian McRobbie, Programme Manager for Ports and Maritime Infrastructure at BMT in the Asia-Pacific region, shares BMT’s experience and ideas regarding collaborating with ports and closing the engineering gaps

Q: Please give us a brief introduction of your role and how you interact with the port sector.

A: I am the Programme Manager for Ports and Maritime Infrastructure at BMT in the Asia-Pacific region and play a pivotal role in the strategic planning and execution of maritime infrastructure projects. My role is to use my expertise and experience to ensure that BMT’s projects not only meet the current demands of the maritime sector but also anticipate future developments and challenges.

In my role, I act as a focal point for maritime infrastructure initiatives, overseeing BMT’s projects and strategies across the Asia-Pacific region. My responsibilities include governance of ongoing projects and engagement with current and prospective clients to ensure BMT’s offerings align with the evolving needs of the maritime sector.

Q: What do you see as the critical factors now when planning and implementing port infrastructure development and guaranteeing a return on investment?

A: I believe that there are several critical factors in port infrastructure development that are crucial for ensuring a robust return on investment. This includes the efficient use of capital in both the construction of new port infrastructure and the enhancement of the operational efficiency of new and existing ports, with a notable industry trend towards the adoption of automated port operations.

Environmental compliance and social licence to operate are also paramount in port infrastructure solutions, encompassing the management of emissions, water quality, noise and light pollution to meet community expectations and regulatory standards.

Finally, futureproofing port

infrastructure is essential, requiring foresight in planning for factors including increasingly larger ships, multi-user and multi-product cargo handling and the integration of renewable or alternative fuels and shore power — which will significantly impact port design and operations in the future.

Q: How has your range of services expanded in recent times to accommodate the new needs of ports; can you highlight one that you see as being particularly successful?

A: BMT has broadened its service offerings to meet the evolving needs of ports, merging environmental expertise with infrastructure design for a holistic port infrastructure design approach. A key example is BMT’s involvement in a 2022 green port initiative at Malaysia’s Port Klang. Here, we conducted a feasibility study for an International Ferry Terminal Development, where our environmental and engineering consultancy services combined to promote a sustainable yet operationally efficient port ecosystem. This project underscores BMT’s ability to provide ‘blended’ consultancy outcomes, offering integrated solutions for the complex demands of contemporary port development.

Q: What do you identify as the main technical factors underpinning port development going forward?

A: Looking ahead, I highlight several technical factors that will underpin future port development. The implementation of flexible digital tools and the development

of digital twins can revolutionise port planning, construction and operations, offering unprecedented efficiency and decision-making capabilities. Moreover, as ports become increasingly integrated within urban centres, technical solutions that mitigate their impact on neighbouring communities, such as the electrification of port operations, increased use of rail over road haulage, and the adoption of low or zero-emission fuels, will be crucial. Utilising digital modelling tools to quantify and validate these mitigations will be vitally important.

BMT’s involvement in enabling the energy transition through our port infrastructure solutions underscores the critical role ports play in supporting marine energy systems, such as offshore wind, tidal and wave power generation. BMT’s expertise in global offshore wind energy, coupled with its comprehensive experience in port infrastructure design and development, positions it uniquely to support the growth of renewable energy infrastructure development in the region and globally. This holistic approach not only addresses the operational needs of ports but also aligns with BMT’s broader environmental and sustainability objectives.

Q: Is there anything you want to add about you and/or your company’s approach to handling the complex challenges relating to modern port operations?

A: BMT’s increasing focus is on innovation, data-driven technologies, and smart port operating models and reflects our commitment to redefining port operations for enhanced efficiency, security, and sustainability, which is what port developers and financiers are increasingly demanding. BMT’s holistic approach is finely tuned to modern day sector challenges. :

The gloom and doom of the economic impacts of high interest rates, stubborn inflation, volatile energy prices and wars across three continents did not bear well for the global economy in late 2022 through 2023. In the U.S., Europe, China and Japan, the various fiscal policies enacted to counter inflation (deemed the evil for economic growth) began to strangle growth, industrial output and trade as most of the G7 economies considered that by fighting inflation the short-term pain would quickly turn into rapid growth with wages kept in check and a rise in investments leading to economic expansion. This return to the policies of the Austerity period which followed the Great Recession of 2010 was akin to a total loss of memory of the impact of the policies enacted during that period. As a result, we are witnessing stymied economic growth in most parts of the EU and Japan, where 2023 has turned out to be so low as to be considered recessionary.

Predictions of GDP growth for 2024 have been ratcheted back by most economic forecasting institutions as the cost-of-living crisis globally and the downward pressure on wages have sparked a reduction in retail sales which, in turn, impacts industrial production and subsequently lower energy consumption.

The exception to this has been the United States, where President Biden pushed for the "Infrastructure Investment and Jobs Act" which came into force in August 2022 augmenting spending of approximately $1.2 trillion, with $550 billion being newly authorised. The U.S. benefited from continuous growth and managed to see inflation reduced with little change in the low level of unemployment. Very counter-intuitive. Perhaps Europe should take note.

The growth was driven by increases in consumer spending, exports, state and local government spending, non-residential fixed investment, federal government spending, private inventory investment, and residential fixed investment. The consistent growth in U.S. GDP is highlighted in Figure 1. Note that this is contrary to developments in Europe, China, and Japan. The

estimated real GDP growth for the year 2023 is put at 2.3 per cent.

The weak EU economies and declining consumer demand in Japan are being felt in international trade as it failed to show much, if any growth at a global level. This had a direct impact on container carriers reported income as highlighted in the adjacent price index, with December 2023 rates registering at around 50 per cent below the same month in 2022.

Then along came the Houthi attacks on shipping passing into the Red Sea with links to Israel, beginning in November last year. Whatever the stated focus of targets was, it became more of a turkey shoot. After the initial uncertainty, most shipping companies opted to re-route via the Cape of Good Hope and for goods destined to the U.S. a diversion via the U.S. West Coast or Panama was also an option. The uninformed media and public institutions warned of rising inflation and shortages as ships could not use the Suez Canal and were faced with much higher costs. As this is not the first time that the Suez Canal was not available, carriers moved quickly to insert additional vessels into their services and to increase transshipment in order to maintain the schedule reliability of the larger ships. Importers in Europe and the U.S. drew down on inventories to avoid undue shortages in the retail sector.

In short order, after a hiatus of a few weeks, revised schedules were in place with little subsequent impact on ports as the normal seven-day service recovered. Negatively impacted are the Suez Canal, Egyptian ports, and notably the Suez Canal Container Terminal, the ports of Aqaba, Jeddah and others. The cost of going around Africa is partly offset by not having to pay for the Suez Canal transit.

So where does this leave us in 2024? Currently in a state of uncertainty is probably the best description. In the latest, January, forecast of the International Monetary Fund (IMF) the predictions have moved from a recessionary outlook defined

U.S. Real GDP

Real GDP: Percentage change from proceeding quarter

U.S. Bureau of Economic Analysis

Seasonally adjusted annual rates

as a hard landing to avoidance of a global recession defined as a soft landing. It projects global growth at 3.1 per cent in 2024 and 3.2 per cent in 2025. The forecast for 2024–25 is below the historical (2000–19) average of 3.8 per cent, however much of the stronger trend in growth comes from the African and Asian developing economies. The advanced economies are projected to have slower growth than in 2023, 1.5 vs 1.6 per cent, driven down by Germany, Italy, the UK and Japan.

The outlook for ports for this year remains relatively good as businesses in Europe and North America will need to replenish their inventories. We expect them to build up those inventories

for more rainy days given the global political risks, but this growth will be cautious, keeping the wars in Ukraine and Israel in mind and the uncertainty of the U.S. political scene, which could very easily change the outlook for 2025.

The OECD data also highlights the lack of optimism for growth in the coming two years.

Focusing on the potential for growth at a more detailed level, we can look at the largest global economy, the U.S., as well as some of the other major economies influencing global trade. It

should be noted that the relationship between GDP and trade has dropped to a ratio of 1:1 or less in recent years and is expected to stay there as the impact of globalisation diminishes. Historically we saw ratios of trade exceeding GDP by up to four.

The World Bank projections for the U.S., featured above, are cautious with growth of around 2.5 per cent going into the longer term, but then, most economists will be hesitant to buck this trend.

India and Vietnam are projected to stay ahead of the pack in terms of strong annual growth rates, well ahead of China which has been the big loser in economic expansion in recent years. China’s growth rate is below 5 per cent looking forward.

The shift away from China has become quite noticeable in recent years, partly due to tariff wars and more recently geopolitical issues linked to the Ukraine war. Focusing on the source of containerised imports for the U.S. in the graphic above, is a bellwether of what is happing in Europe as well.

These two charts show a similar picture, the left focused on tonnage and the right on value. They compare the change in containerised imports over the past five years from a number of regions. The countries and regions account for about 85 per cent of the containerised tonnage each year and 88 per cent of the value.

China is a clear loser, with ASEAN and South Asia benefiting in the shifting trade patterns.

The trade war and the introduction of tariffs, followed by the pandemic, saw US-based businesses look for additional sources for their cargo. And while it’s clear that China has lost market share, it’s equally clear that it still dominates. There’s been much talk about the surge in volume coming from Vietnam,

Cambodia, Indonesia, and India…but in terms of gaining market share it’s a just a few percentage points over the past five years.

One thing is certain, it will be a rocky period ahead, with continuing pressures on both the Suez and Panama canals, albeit for different reasons, as well as weakening consumer demand in the EU and the U.S. Ports however, appear to face the least risk. :

While China has lost market share it is clear that it still dominates

Grimaldi is still owned by the same family that founded it and the company has successfully developed a specialist network using flexible roll-on/roll-off vessels

AJ KEYES

Established in 1947, Grimaldi is a fully integrated multinational logistics group specialising in the maritime transport of cars, rolling cargo, containers and passengers. It is wholly owned by the Grimaldi family.

The Grimaldi Group is today one of the world’s leading ship owners and is at the forefront of the maritime transport of rolling freight, as well as the European leader on the Motorways of the Sea. The Neapolitan group is led by Gianluca Grimaldi, Emanuele Grimaldi and Diego Pacella – pictured.

The group additionally operates a network of port terminals and logistics companies, forming an integrated logistics chain, and is also active in the passenger and container transport sectors.

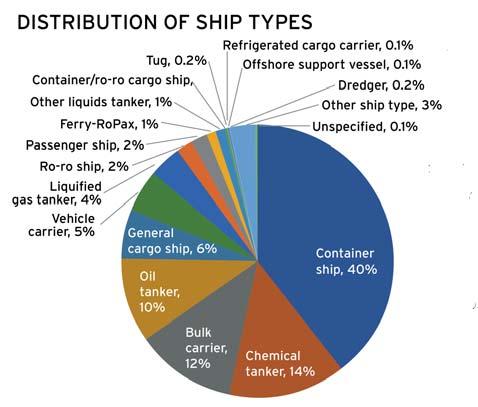

The Grimaldi Group comprises six different shipping companies, operating a total fleet of 120 ships consisting of roll-on-roll-off (ro-ro) vessels, including pure car and truck carriers (PCTC), ro-ro multipurpose, ro-ro container and ro-ro passenger ships.

In addition to family ownership of the company, fleet additions and acquisitions/ shareholding participations remain the Grimaldi strategy.

Atlantic Container Line was purchased in 2001, control of Finnlines occurred in 2006, with all shares acquired in 2016, and a majority stake in Greek domestic ferry and ro-ro operator, Minoan Lines, dates back to 2008.

Grimaldi is recognised as a shipping system innovator with its G5 class vessels and its hybrid ro-ro vessel design,

belonging to what it dubs as the Grimaldi Green 5th Generation (GG5G) class, standing out as a prime examples of this.

The latest vessel in the G5 series is the Great Tema, delivered to the Grimaldi Group at the Hyundai Mipo Dockyard in Ulsan, South Korea in late December. She joins the Great Antwerp and Great Lagos, delivered in April and August 2023 respectively, operating between North West Europe and West Africa with this service route also to benefit from three further vessels of the same class which are yet to be delivered.

The design of the Great Tema, Grimaldi reports, is the result of an in-depth study of client needs with notable features including: a large cargo capacity of 4,700 linear metres of rolling freight, 2,500 CEU (Car Equivalent Units) and a container capacity of 2,000 TEU; diverse solutions aimed at increasing energy efficiency and reducing environmental impact and in the latter respect the ability to cold iron in port (to be supplied by shoreside power where available).

Grimaldi states that Great Tema’s main engine and the auxiliary diesel generators will meet the NOx levels imposed by the Tier III regulation, while the integrated propulsion system between rudder and propeller will minimise vortex losses and, consequently, optimise propulsion efficiency and reduce

fuel consumption. In addition, the electrical consumption of on-board machinery (pumps, fans, etc.) is said to be reduced due to the installation of variable frequency drive devices, while the application of innovative, low friction paints reduces hull resistance, thus increasing efficiency. Further, the vessel is equipped with hybrid exhaust gas cleaning systems for the abatement of sulphur and particulate emissions.

Overall, Grimaldi estimates that the Great Tema will enable a reduction of up to 43% of CO2 emissions per tonne transported compared to other con-ro vessels in its fleet.

Great Tema has a beam of 38m, a length of 250m and a deadweight of 45,684 tonnes. The container capacity is basically twice that of the earlier design

vessels operating on the North Europe –West Africa service.

The Eco Italia is the latest delivery of its GG5G vessel class, delivered by the Chinese Jinling shipyard in Nanjing in October 2022. She will be followed by two further deliveries of the same class by 2025, also to be deployed in the Mediterranean and Northern Europe. This will bring the fleet in the hybrid ro-ro class up to a total of 14 vessels.

Representative of the class, the Eco Italia has a length of 238m, beam of 34m, a gross tonnage of 67,311, and a service speed of 20.8 knots. The loading capacity of her seven decks — two of which are movable — is twice that of the previous generation of vessel employed by Grimaldi in this trading area. Capacity comprises 7,800 linear metres of freight, equivalent to around 500 trailers and 180 cars. As with its GG5G class of vessels, the hybrid ro-ro design incorporates many positive energy efficiency and reduction of negative environmental energy features with its ‘zero emission in port’ target notable in the latter respect. The Eco Italia uses the electricity stored in mega lithium batteries with a

total power of 5 MWh for the latter purpose.

Landside focus

Recent times have also demonstrated Grimaldi’s strong interest in extending its influence along the supply chain. In January 2024, Terminal Darsena Toscana (TDT), the Livorno container terminal, was acquired from Infracapital and this was preceded in December 2023 by the acquisition of a majority stake in the capital of Heraklion Port Authority (HPA S.A.) via Holding of Heraklion Port S.A., the consortium formed by the Grimaldi Group companies Grimaldi Euromed SpA and Minoan Lines S.A. Heraklion is the island of Crete’s busiest port. Grimaldi continues to advance on a broad basis — shipping, ports and logistics.

The Grimaldi Group retains a well-defined operating strategy — flexible cargo operations with family-ownership. :

MIKE MUNDY Editor and Independent Analyst

MIKE MUNDY Editor and Independent Analyst

It seems India is considering taking a leaf out of China’s pocketbook by securing port capacity overseas.

China’s Belt and Road Initiative (BRI) has seen some significant success, albeit that like China’s economy today it is not achieving the rapid growth that it has in the past. Independent analysis suggests that by end December 2023, based on the number of countries that have signed a Memorandum of Understanding with China, approximately 150 countries had signed up to the BRI.

The geographical spread is broad-based, with the highest take-up for the BRI, not surprisingly, seen in Sub-Saharan Africa with 44 companies registered in this respect. Europe and Central Asia comes next, with 34 countries, then East Asia and the Pacific with 25, Latin America and the Caribbean with 22, the Middle East and North Africa with 19 and Southeast Asia with six. Interestingly, this includes 17 countries in the European Union and eight countries in the G20 grouping.

for trade, which has been so key to the country’s development.

India initiative?

There is no real head-on competition to the BRI. In 2021, the “Build Back Better World” project was launched at the midyear G7 summit, but this has never really taken off. It can in fact be consigned to the overflowing basket of political rhetoric.

So, is India, a fast-emerging economic power, about to come up with its own form of BRI? Yes, for sure in the first instance and possibly in the second. There are some fledgling signs of this.

‘‘ MIKEMUNDY, Editor and Independent Analyst

The slowdown in the take-up of the BRI is particularly notable from 2020 onwards. There are diverse reasons for this: concern over the costs associated with the BRI, the complete loss of the asset to China as a result of the inability to pay for projects (as in the case of the Hambantota Port, Sri Lanka), China itself scaling down lending, security issues, political concerns, increased competition from conventional funding and so on.

There is no doubt, however, that in its early growth years, when it was hailed by President Xi Jinping as the “project of the century”, it did rack up some significant successes. Clearly, China has enjoyed some significant success as regards the underlying objective of China extending its global economic reach through the BRI, widening the scope

Kyriakos Mitsotakis, Prime Minister of Greece, recently made a trip to India, where he reportedly experienced strong interest in a variety of business deals across multiple sectors, most in established fields but, notably, one that is "a new kid on the block". India, according to informed sources, wants to mirror China’s actions and acquire a port in Greece via which it can connect commercially with the European Union. Further, India expressed interest in developing large logistics centres in the Balkans.

Will these ideas become a reality? Greece’s two major ports of Piraeus and Thessaloniki are already in private ownership, with Chinese interests in the majority in Piraeus. As such, there don’t appear to be any suitable candidate ports available. But who knows what the future might bring? :

MIKE MUNDY is a well-known commentator and independent analyst of the global maritime sector. He has edited a number of prestigious publications and worked in a consultancy capacity with leading port sector businesses

Green Ports and Shipping Congress will identify and prioritise the areas that ports-based organisations and shipping companies need to collaborate on to reduce emissions.

Green Ports & Shipping Congress will cover a range of topics including:

• Maritime Digitalisation

• Green Shipping Corridors

• Future marine low and zero-carbon fuels

• Bunkering infrastructure including multi-fuel bunkering transition

• Safety standards and regulations

• Green Technologies including carbon capture, storage, and utilisation

• Green Finance - bridging the gaps in collaboration

• Incentivised Shipping – how ports can incentivise shippers to make green changes

• Collaborative projects

• Voyage planning and optimisation

• Onshore Power Supply

• The role of ports and shipping in the transport of zero carbon fuels

PAKISTAN PORT DEVELOPMENT

PAKISTAN PORT DEVELOPMENT

Not without controversy, Pakistan has recently made progress with securing inward port investment but big challenges remain for the port system’s full potential to be unlocked

he ongoing economic crisis and persisting security risks will determine the future of the Pakistani seaport infrastructure development for decades ahead. While some ports attract investments, critically important big infrastructure projects appear to be in jeopardy.

TOn August 10, 2023, the Pakistani government approved a landmark commercial agreement to hand over exclusive operations and development rights for over 85% of the east wharf of the Karachi seaport to the AD Ports Group.

Few deals involving foreign investors have caused such a backlash in Pakistani society. Muzzammil Aslam, a spokesperson of a prominent Pakistan political party, for example, wrote in his blog that handing over the port for “this meagre US$50 million” didn’t make economic sense.

The inconsistent positions of government officials have fueled the outrage. The Cabinet Committee on InterGovernmental Commercial Transactions — a body empowered to approve the agreement — publicly described the deal as “below par” only a few days before giving it a green light.

A part of Pakistani society sees this transaction as a forced decision. This was the first agreement, signed under a procedure established in 2022 for selling state assets on a fast-track basis to raise emergency funds.

The emergency funds are needed to help buttress the national economy severely hurt by the COVID-19 pandemic and, most recently, catastrophic floods, which have displaced over 20 million people, destroyed infrastructure in several regions and effectively left the economy in tatters with external debt soaring to US$125bn and inflation reaching a record 38%.

The deal will help inject funds for the strained national budget and have the benefit of securing the inflow of muchneeded investment in port infrastructure.

Under the terms of the deal, AD Ports Group will pay US$25 million upfront, adjustable against revenue sharing in the next seven years, with US$3 million per annum for the first five years and US$5 million each in the next two years. The company will also invest US$220 million in the first ten years of operation in the Karachi port.

Pictured: Pakistan’s ports are seeing new investment but challenges remain

AD Ports Group has recently shown determination to double down on its Pakistani business. On February 7, Karachi Gateway Terminal Multipurpose Ltd, a joint venture between AD Ports Group and another UAE-based company, Kaheel Terminals, rolled out a 25-year concession agreement to develop, operate and manage the bulk and general cargo terminal berths 11-17 at Karachi Port’s East Wharf.

The deal technically gives AD Ports Group full operational control over Karachi Port’s East Wharf.

The joint venture also unveiled plans to invest approximately US$75 million in the first two years, including upfront fees, prepayments and investments in superstructure and equipment, followed by further investment of US$100 million within five years. The latter will be used to increase efficiency and capacity by 75%, enabling the terminal to handle up to 14 million tonnes per year.

Despite the public criticism, people familiar with the matter believe that securing cooperation with AD Ports Group represents a success for the Pakistani government.

Pakistan is pursuing the landlord port model, which incorporates the world’s best practices of attracting investors into infrastructure development, comments Dr Anjum Sarfraz, former Senior Research Fellow at the National Institute of Maritime Affairs in Islamabad.

“The quay walls are given to terminal operators on concession agreement on lease with certain terms and conditions,” Dr Sarfraz indicates, emphasising the rules of the procedure are transparent, including in the case of the Karachi port agreement with AD Ports Group.

Pakistani seaport development in the coming years is associated with its three largest ports: Karachi, Bin Qasim and Gwadar.

According to Dr Sarfraz, Karachi and Bin Qasim, which is also located in Karachi, suffer from infrastructure challenges, such as traffic congestion. In addition, Karachi is located relatively far away from the main shipping routes.

Although the agreement with AD Ports Group marks an important milestone for the Pakistani seaport industry development, UAE businesses have a long track record of working in Pakistan.

DP World began operations in Pakistan in 1997 at the Qasim International Container Terminal (QICT) — the first of its kind in the country, notes Andre Martin, Vice President, DP World. Over the years, the company’s efforts have transformed the facility into a leading gateway for global trade in the region.

Generally, Pakistani seaport infrastructure is about to benefit from the political rapprochement pursued by Pakistan and UAE officials.

“Following the recently signed framework agreement between the governments of Pakistan and Dubai, we will also develop an Economic Zone at Port Qasim, with the aim of attracting more investment and maximising economic activity,” Martin discloses.

DP World’s plans also include further improvement of the terminal infrastructure and equipment, as well as dredging of the navigation channel.

“In addition, we are developing our freight forwarding capabilities and establishing intermodal terminals, along with IT-enabled solutions to further enhance efficiency in warehousing and trucking, as part of our drive to become an end-to-end logistics services provider,” Martin notes.

Further, in cooperation with Pakistan Railways, DP World plans to develop a dedicated rail freight corridor to run from Karachi Port on the Arabian Sea, passing through Karachi, to the Pipri Marshalling Yard, approximately 45km away, where the company wants to establish an Inland Container Depot.

“This will improve efficiency and transport times, and reduce the overall cost of logistics,” Martin explains.

According to Dr Sarfraz, the importance of relevant infrastructure development is hard to overestimate. The planned development should considerably reduce the traffic congestion in Karachi and eventually make Qasim port operations much more effective.

Gwadar is on shaky ground

Gwadar port, having a strategic location at the mouth of the Persian Gulf on the main shipping routes, is seen by some to have good opportunities. Its location is considered most suitable to operate as a transshipment hub, Dr Sarfraz is confident.

The future of Gwadar port is closely associated with the China-Pakistan Economic Corridor (CPEC), a massive bilateral project to improve infrastructure within Pakistan for better trade with China.

CPEC is an essential part of the Belt and Road Initiative to improve connectivity, trade, communication and cooperation between the countries of Eurasia. It was launched on April 20, 2015, when the Chinese President. Xi Jinping, and Pakistani Prime Minister Nawaz Sharif signed 51 agreements and memorandums of understanding valued at US$46 billion.

Practically speaking, however, the future of Gwadar port looks difficult, as the CPEC project has reportedly stalled.

Michael Kugelman, a South Asia expert at the Washingtonbased Woodrow Wilson International Center, believes that the same worsening economic crisis that paved the way to the Karachi seaport deal with AD Ports Group, coupled with security concerns, has made the Chinese side wary of pedalling the CPEC development.

“CPEC has faced momentum losses due to Pakistan’s economic crisis and growing security threats, both of which have made Beijing more reluctant to invest in new CPEC projects. The stakes are especially high for the Gwadar port project, because it has long been viewed as a cornerstone yet to this point an unfulfilled project of CPEC,” Kugelman says.

‘‘

In the past, Chinese citizens and workers were the targets of similar terroristic attacks — a factor looking particularly concerning for Beijing.

“Gwadar is in a region with a long legacy of insurgency and other violent threats, and CPEC’s large presence in Balochistan makes it an especially big target for separatist insurgents,” Kugelman adds.

Despite the challenges, the outlook for Pakistan’s seaport development looks mostly bright, according to market players.

The future for Pakistan’s seaport infrastructure development is positive and will have a beneficial cascading effect on the overall economy, Martin claims.

“Key factors determining its future include strategic investments, advancements in technology, global trade dynamics and effective public-private partnerships,” Martin says.

If CPEC fails or even slows down, Gwadar could be one of the biggest casualtiesMICHAEL KUGELMAN, Woodrow Wilson International Center

China sees the development of the Gwadar port as a vital project, since it could serve as an alternative to the Strait of Malacca — a narrow waterway between Indonesia and Malaysia, through which China imports roughly 80% of its crude oil.

“If CPEC fails or even slows down, Gwadar could be one of the biggest casualties,” Kugelman underlines.

The security concerns are more than real. On January 29, 2024, heavily armed terrorists launched three coordinated attacks, including one on a high-security prison in Pakistan’s Balochistan province, where Gwadar sits.

“Beijing is especially concerned about security threats to its investment assets and interests in Pakistan, given that the upsurge in terrorism attacks in Pakistan in recent months has hit Balochistan especially hard,” Kugelman.

Pakistan’s ports have yet to unravel their true potential as transit hubs for China, Afghanistan and Central Asian countries, Dr Sarfraz suggests. Additional investments in connecting infrastructure such as rail are also seen as catalysts for traffic development.

“Factors such as enhanced connectivity, streamlined logistics and the ability to accommodate larger vessels will play a crucial role in shaping the future landscape of Pakistani seaport infrastructure,” Martin agrees.

In the near term, Pakistan is set to receive an investment of up to US$1 billion in its struggling railway sector, coming not only from the UAE but also from Russia, which is interested in establishing a new transport artery to Asia.

Yet, this figure is dwarfed by a US$58 billion investment into a railway system connecting Pakistan to Western China pledged by the Chinese authorities within the Belt and Road Initiative, the future of which remains highly uncertain.