Establishing multilateral power trade in ASEAN

About this report

This report identifies a set of minimum political, technical and institutional requirements that the ASEAN member states will need to meet in order to establish multilateral power trading in the region. Some of these minimum requirements can be met by building upon existing efforts in the region. The report also proposes a set of trading arrangements of increasing levels of ambition which, taken together, will enable ASEAN to establish multilateral power trading in a manner that is consistent with maximising national sovereignty and the equitable sharing of benefits. These recommendations include a summary of potential roles for regional institutions and an example transaction to show how trading might potentially work in practice.

This publication is supported by the Government of Australia through the ASEAN–Australia Development Cooperation Program Phase II (AADCP II).

Executive summary

The Association of Southeast Asian Nations (ASEAN) member states (AMS) have a long-standing goal of integrating their power systems via a common ASEAN Power Grid (APG). To date, development of the APG has primarily focused on cross-border infrastructure and bilateral trading. The AMS have also long recognised, however, that to fully unlock the benefits of the APG they will need to establish some form of multilateral trading in the region. The intent of this study is to provide the AMS with a set of concrete recommendations for how to establish multilateral power trading in the region. These recommendations are guided by international best practices, but also by recognition of ASEAN’s unique context. This context includes a set of core principles that multilateral power trading must respect, including stepwise and voluntary development and maintaining national sovereignty.

Many models of multilateral power trade

Multilateral power trade can be categorised across many different dimensions. Limited models may involve relatively small amounts of trading relative to domestic consumption, and could even be unidirectional in nature, while complete models of trade involve the integration of domestic systems in a single common regional market. There is also a temporal element to trade, with some forms of trade occurring over long time horizons (such as long-term power purchase agreements) and others occurring close to real time (for instance, the intraday or day-ahead time frame).

Multilateral power trading can also be considered in terms of how it fits into national system operations. “Primary” models of trade are ones where regional, multilateral power trading is the default mode. “Secondary” models are ones where regional trading takes place as an additional option on top of domestic market or system operation arrangements. In an ASEAN context, as in other parts of the world, multilateral trading is in a nascent stage, where most or all existing trading is bilateral in nature, but there is a clear desire to implement multilateral trading of one form or another.

To put the ASEAN region in appropriate context, and to better understand international best practices, a set of international case studies was developed to support this study. Eight case studies were developed in total, including two in North America, one in Europe, two in South Asia, one in southern Africa, one in Central America and one in the Persian Gulf region.

Minimum requirements

There are certain minimum requirements to establish multilateral power trading in the ASEAN region. These requirements fall into three categories: political, technical and institutional.

Political requirements include broad areas such as intergovernmental agreements, and narrow ones, such as an agreement on a common working language. They also include the presence of a difficult-to-define but nevertheless critical element – political will.

There are numerous technical requirements for establishing multilateral trade. These include harmonised grid codes, a harmonised wheeling charge methodology, provisions for third-party access to domestic grids, agreements on data and information sharing, and a dispute resolution mechanism.

Finally, institutional requirements include additional responsibilities for existing institutions, which may in turn require additional capacity building, and the establishment of new institutions that can take on responsibility for new functions, such as market organisation.

Once these minimum requirements are in place, the AMS will be able to develop multilateral power trading in the region.

Proposed trade models for ASEAN

This report proposes three trade models for the ASEAN region. These models are of increasing levels of ambition, and are intended to be compatible with ASEAN’s core principles, in particular stepwise and voluntary development.

First, it is recommended that the AMS develop a harmonised bilateral trade model. This would involve three key elements: a set of standardised bilateral contract templates, a standard wheeling charge methodology and a “regional co‑ordinator” institution. Taken together, this would allow for any individual AMS to enter into bilateral trading agreements with any other AMS, regardless of whether they share a border. While this does not fulfil the broader goal of establishing multilateral power trading, it would improve the efficiency of bilateral trading in the region while also laying the groundwork for more formal multilateral trading.

Second, ASEAN should develop a secondary trading model. As defined above, a secondary model involves the development of a regional market that exists separately from national markets and system operations. This would build upon some elements established in the harmonised bilateral model, such as harmonised wheeling charges, and introduce new elements, such as a regional market operator and a central clearing party.

Finally, a more future-oriented primary trading model is proposed. Under this option, AMS could choose to replace their national markets with a fully integrated regional market. This would bring additional benefits to participating countries, but would also require more changes at the national level, including market restructuring.

Taken together, these options allow the AMS to make rapid progress on power system integration via the APG, while also enabling each country to make its own decisions as to when and how it chooses to participate in regional multilateral trading.

Highlights

With increasing shares of variable renewable energy in ASEAN, multilateral power trade can benefit the ASEAN Member States in terms of both increased system security and economic efficiency due to resource sharing.

Multilateral power trade can be categorised across multiple dimensions, including from limited to complete, and from long-term to short-term trading. More complete and short‑term models require more regional co‑ordination.

International experiences show that it is possible to develop multilateral power trading while respecting national autonomy. Establishing multilateral trading in an ASEAN context, however, requires an understanding of the region’s unique circumstances and country‑specific priorities.

A number of political, technical and institutional minimum requirements must be met in order to establish multilateral trading in ASEAN. There are, however, no fundamental obstacles to meeting these requirements.

A number of existing efforts in ASEAN – in particular the Lao PDR–Thailand–Malaysia–Singapore Power Integration Project and the Greater Mekong Subregion – can serve as starting points for work in ASEAN.

Three trade models are proposed for ASEAN. First, a harmonised bilateral model should be established to improve the efficiency of bilateral trading in the region and to lay the groundwork for multilateral trading. Next, a secondary trading model should be introduced, creating a regional market for countries to use in addition to existing domestic markets or operations. Finally, for countries that wish to do so, a primary trading model could be introduced which would replace domestic markets with a unified regional market.

Key findings

Overview of study

The Association of Southeast Asian Nations (ASEAN) member states (AMS) have a long-standing goal of integrating their power systems via the ASEAN Power Grid (APG). Development of the APG has, to date, been limited primarily to the development of cross-border transmission lines on a bilateral basis. Power trade has similarly been organised bilaterally, including through cross‑border power purchase agreements (PPAs) and bilateral trading without financial compensation. The bilateral power trades that are currently organised are a great first start, but in the future with more variable renewable energy in the ASEAN region, more structured market set-ups with shorter time frames may be needed.

To realise the full potential of the APG, though, the AMS will need to establish multilateral power trading. Doing so would allow the AMS to tap into the potential benefits of an integrated ASEAN power system, including reduced costs and an increased ability to integrate variable renewable energy (VRE) resources.

Multilateral power trade will allow the AMS to take advantage of the resource diversity of the region, as well as create an additional source of flexibility, which will allow them to integrate higher shares of renewables. Multilateral power trade is therefore a framework to increase system security and increase economic efficiency, and an enabler of meeting renewable goals in line with the decarbonisation agenda.

At the same time, any multilateral power trading arrangement established in ASEAN will need to be compatible with certain core principles, including voluntary participation, stepwise development and respect for national autonomy.

Categories of multilateral power trade

Cross-border power trade exists across a spectrum of integration, ranging from limited efforts such as bilateral, unidirectional trades, to multilateral trading models that allow for trading among various jurisdictions, to fully unified models that include market participants from multiple states or countries. Nearly all trading in ASEAN can be described as bilateral between neighbouring countries. For example, Thailand currently imports electricity from the Lao People’s Democratic Republic (Lao PDR) under various long-term PPAs.

The only example of multilateral power trading in the region is among Lao PDR, Thailand and Malaysia. Here, Malaysia purchases power from Lao PDR under a predefined set of terms regarding price and quantity, and Thailand acts as the transit, or wheeling, country. This example, however, is multilateral only in the sense that it involves an agreement among more than two countries. The trade and associated power flow is unidirectional, and there is no generalised framework for allowing trades between any combination of the participating countries – something that would be necessary for it to be considered a true multilateral, multidirectional trading environment.

Cross-border trading also has temporal attributes. As noted above, most cross-border trading in ASEAN is done under long-term contracts. Trading can also be done closer to the time of delivery, for example in the day-ahead time frame. It is even possible to have real-time trading, such as balancing services. In the context of this study, multilateral trading primarily refers to day-ahead trading, though other types of trading may also be referred to if and when relevant.

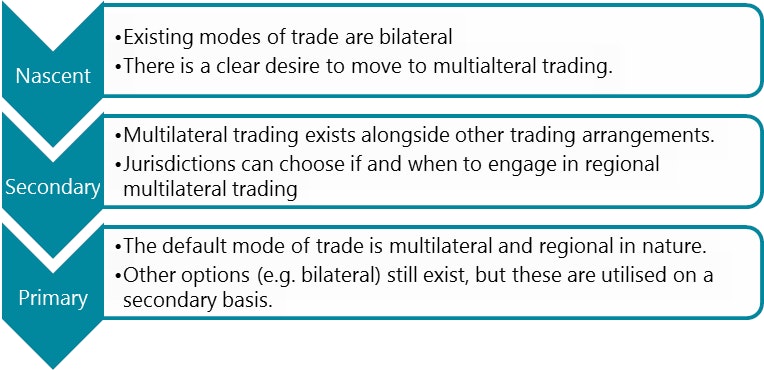

Finally, there is a third way to group multilateral trading efforts: by the level of development and the relative role of regional trading as compared with local (i.e. within jurisdiction) alternatives. Multilateral trading arrangements fall into three categories: nascent, secondary and primary (Figure 1).

Nascent arrangements are ones where existing modes of trade are bilateral, but there is a clear desire among the respective jurisdictions to move to multilateral trading. Secondary arrangements are ones where regional multilateral trading exists alongside, and therefore in addition to, other trading arrangements. Jurisdictions are therefore able to choose if and when to participate in regional multilateral trading. Finally, in primary arrangements, the default mode of trade is multilateral in nature. Other options of trade (in particular, bilateral) can and usually do still exist, but typically they are utilised on a secondary basis compared with multilateral trading.

Figure 1. Categories of multilateral power trade

IEA 2019. All rights reserved.

International experiences in multilateral power trading

ASEAN is hardly the first region to seek to establish multilateral power trading. Examining efforts in other regions can provide some lessons that may be useful in an ASEAN context.

To get a broad range of experiences, eight regions were examined for this study. These were divided into the three categories of nascent, secondary and primary trading arrangements (Table 1).

Table 1. International case studies examined in this report

| Category | Trading arrangement |

|---|---|

| Primary | PJM |

| ISO New England | |

| Nord Pool | |

| India | |

| Secondary | Southern African Power Pool |

| SIEPAC (Central America) | |

| Nascent | Gulf Cooperation Council Interconnection Authority |

| South Asia Regional Initiative for Energy Integration |

Four of the case studies are primary arrangements. PJM and ISO New England are both regional power markets covering multiple states within the United States. Nord Pool is a regional wholesale market covering multiple countries in northern Europe. Finally, India has, over a number of years, managed to fully integrate its domestic power system into a single market covering the entire country.

Two of the case studies fall into the category of secondary trading arrangements. The Southern African Power Pool (SAPP) allows for multilateral trading among multiple countries in southern Africa, while SIEPAC does the same (albeit in a structurally different fashion) for six countries in Central America. Both exist as separate market arrangements that sit above (or separately from) local, in-country power market arrangements.

Finally, two nascent efforts were analysed: the Gulf Cooperation Council Interconnection Authority (GCC IA), and the South Asia Regional Initiative for Energy Integration (SARI/EI).

Though these examples are all quite different, a number of lessons relevant to an ASEAN context emerged from the analysis.

First, in all cases integration supported by multilateral trading was found to bring both economic and security benefits. Economic benefits derive, for example, from the more optimal utilisation of local and regional resources. This can lower operating costs, and can also support the development of larger (and therefore more economically efficient) power plants. Energy security benefits come in part from increased system diversity (in particular supply diversity, though demand diversity also brings benefits), and in part from increased visibility into other, interconnected systems. Physical integration among multiple jurisdictions without the presence of trading arrangements increases exposure to external influences while limiting the ability for local system operators to respond to those influences.

Second, each case demonstrated that it is possible to participate in multilateral trading arrangements while maintaining local sovereignty. It is also possible to develop trading arrangements that ensure an equitable sharing of benefits. All of the various international examples analysed in the context of this study respected the ASEAN principles for multilateral power trading. However, it is also clear that increased integration requires increased levels of cross-border collaboration and harmonisation.

Finally, in each of the regions studied, integration and the establishment of multilateral trading was supported by the presence of various regional institutions. The exact roles and responsibilities of these institutions varied across regions, but in each case the institutions had critical roles to play.

Minimum requirements for establishing multilateral power trading

Reviewing international experiences also brought to light a set of common elements that could be considered “minimum requirements” for establishing multilateral trading in a region. In an ASEAN context in particular, these requirements would need to be met first before it would be possible to establish a full multilateral, multidirectional trading framework.

These minimum requirements can be grouped into three categories: political, technical and institutional.

Figure 2. Minimum requirements for establishing multilateral power trade

IEA 2019. All rights reserved.

Political requirements

Political requirements include relevant intergovernmental agreements, and agreement on certain fundamental, but non-technical, issues such as a common working language. Analysis of or recommendations related to specific intergovernmental agreements is beyond the scope of this study, but for example, agreements may be needed to establish and/or designate specific authorities to relevant regional institutions. Another key political requirement is political will. Though difficult to define precisely, political will to support integration is nevertheless a crucial element, as it is one of the elements that differentiate cross-border integration from power system development within a single jurisdiction. Without political support across the relevant jurisdictions, no amount of technical work will be sufficient for integration to fully succeed.

Technical requirements

Technical requirements cover a broad range of topics, but in essence this category refers to the rules and procedures required to ensure that cross-border trade can function in a secure and efficient manner. For example, harmonised grid codes help to ensure that power system operations across interconnected systems are not in conflict with one another. Similarly, a harmonised wheeling charge methodology is necessary to allow trading between any combinations of AMS regardless of whether they share a border.

Data- and information-sharing agreements are even more fundamentally important, as without a clear agreement on which data to share and which data should be kept private, trading is not possible. In practice, data and information will fall into different categories of sensitivity. Information about existing contracts or critical infrastructure can and should remain private at the national or jurisdictional level. Some data, such as dispatch schedules and generator-specific bids and offers, will need to be shared regionally, but access to that data can be limited to regional market participants only. There are clear benefits, however, to making some data publicly available on a regional basis, including, for example, available transmission and generating capacity, historical information on cross-border power flows, and average clearing prices for regional trades.

Institutional requirements

Finally, as noted above, international experiences show that multilateral trading and regional integration more broadly are best supported by regional institutions. In an ASEAN context in particular, additional institutional arrangements will be necessary to establish full multilateral trading in the region. This will include both additional capacity building at existing institutions, and potentially the development of new institutions. Some of these new institutional arrangements will go to support functions such as a settlement and payment mechanism and a dispute resolution mechanism.

Figure 3. Data and information sharing: Private versus public

IEA 2019. All rights reserved.

Building upon existing efforts

Though there is much work to be done to establish full multilateral trading among the AMS, ASEAN is hardly starting from scratch. Two subregional efforts in particular are worth highlighting: the Lao PDR–Thailand–Malaysia–Singapore Power Integration Project (LTMS–PIP) and the integration effort in the Greater Mekong Subregion (GMS).

LTMS–PIP

The LTMS–PIP is a “pathfinder” project that is meant to demonstrate that multilateral power trading is possible in an ASEAN context. As it stands today, the LTMS–PIP involves the sale of electricity from Lao PDR to Malaysia, with Thailand acting as a transit, or wheeling, country.

The LTMS–PIP has demonstrated that power trading among multiple AMS is possible. What remains to be seen is whether it can be expanded to include more than three countries, and generalised to allow for multidirectional trading among any set of participants. Nevertheless, much of the work done under LTMS–PIP is relevant for establishing a general framework for multilateral trading in the region. For example, the LTMS–PIP includes a wheeling charge methodology that could become the basis for a harmonised regional model.

The process of developing the LTMS–PIP has also been instructive. It involved the establishment of separate working groups that gave each of the stakeholders a role in developing the power trade, even if, in the end, they chose not to participate. This sharing of responsibilities is one way to encourage all of the AMS to participate in the development of full multilateral trading, even if they do not expect to see an immediate benefit from it. Finally, the LTMS–PIP development process included the establishment of a detailed timeline for development with concrete deliverables and milestones. Having this in place gave all stakeholders a clear view of their respective roles, and made it easier to judge overall progress.

GMS

The GMS includes six countries. Five are AMS, while the sixth is the People’s Republic of China (specifically, southern China). Efforts to integrate the power systems of these six countries have been ongoing since the early 1990s, and the GMS effort as a whole has existed in parallel to the development of the APG.

Establishing multilateral power trading in the GMS is one of the outstanding goals of the region. As with the APG effort, however, progress to date has been limited mainly to the establishment of various bilateral trading arrangements. Notable progress has been made, however, in a variety of technical and procedural areas, all of which offer lessons for efforts to establish multilateral trading among the AMS.

In terms of technical requirements, for example, the GMS effort has led to the development of draft harmonised grid codes and a draft wheeling methodology. While these have not been formally implemented, the development process did include five of the ten AMS, suggesting that these could provide a good starting point to developing a more general set of harmonised grid codes for the region as a whole.

The process of developing the GMS also has a number of positive lessons for the APG. In particular, progress has been made in a GMS context in large part because of the regular sharing of relevant information among the participating countries, such as grid plans.

At the same time, some of the challenges the GMS effort has faced offer lessons for ASEAN as well. For example, the GMS effort includes a proposal to develop a regional control centre. This effort has stalled, however, in no small part due to disagreements over where the institution should be located. The GMS effort also demonstrates the challenges, but also potential benefits, of including non-AMS in the process.

Proposed trade models for ASEAN

Once the minimum requirements are met, it will be possible to establish multilateral power trading in ASEAN. To do so, three trade models are proposed. These are meant to enable the development of multilateral trading while respecting ASEAN principles such as stepwise and voluntary development.

There is no requirement that each individual AMS participate in all of the various trade models, if and when they are developed.

These models are also designed to be compatible with one another, so that it will be possible for more than one model to exist simultaneously.

The proposed models are as follows. As a near-term step, it is recommended that ASEAN establish a framework to support harmonised bilateral trading. Then, as a medium-term step, the AMS should establish a secondary trading model. This would enable true multilateral, multidirectional power trading for the first time in the region. Finally, as a longer-term step, ASEAN should consider establishing a primary trading model, which would enable deeper integration and power trade among the participating countries.

Here is how these models would work in practice.

Harmonised bilateral trading

In the harmonised bilateral trading model, the AMS would develop a common framework for entering into and managing cross-border bilateral contracts. In essence, this model builds upon existing bilateral arrangements in such a way as to improve the efficiency of the process, and to allow any two interconnected AMS to trade with each other, regardless of whether they share a border.

To do this, the harmonised bilateral model introduces three key elements.

First, the AMS would develop a set of standardised bilateral contract templates. These would be relatively flexible contract templates that would provide a common starting point for any two countries (or market participants) to enter into a bilateral agreement. Second, the AMS would introduce guidelines for wheeling methodologies, as described above. This would allow any two AMS to trade with each other by ensuring that “transit” countries are compensated for the use of their grid.

Finally, this model would introduce the option for a “regional co‑ordinator” institution, which would act as an enabler of bilateral trading. The regional co‑ordinator would, in essence, only collect and share information, such as available transmission capacity, willingness among participants to trade and relevant information on signed bilateral contracts. It would not be directly involved in the transactions themselves.

While harmonised bilateral trading is not equivalent to full multilateral trading, with these elements in place it would be possible for the AMS to enter into a more flexible and diverse set of bilateral trading arrangements. At the same time, having the key elements of the harmonised bilateral trading model in place would set the stage for more formal multilateral arrangements.

Secondary trading model

A secondary trading model is, at its core, a regional power market that individual AMS (and other relevant market participants) can use in addition to domestic system operations or markets. Under the proposed model, only excess generation or supply gaps would be traded. Domestic markets or power systems would clear first, and the secondary market would be used only if and when doing so adds value to participating AMS.

Establishing a secondary trading model would enable full multilateral, multidirectional power trading among the AMS, while remaining fully compatible with harmonised bilateral trading. This would require the introduction of a number of new elements, some of which build upon the harmonised bilateral model, and some of which are unique to this model.

As a starting point, some of the core elements required to establish harmonised bilateral trading are relevant in a secondary trading model context as well. In particular, the wheeling model introduced as part of the harmonised bilateral model would also enable wheeling in the secondary model.

One new element that would need to be introduced in the secondary model is a regional

market operator. The market operator would collect information on excess supply and demand, match potential trades, and provide relevant information to the AMS. It could also, potentially, aid in wheeling charge calculations. As some of these functions are similar to the recommendation for a regional co‑ordinator role in the harmonised bilateral model, one option would be for the recommended regional co‑ordinator institution to take on the market operator responsibilities as well.

Because trading in a secondary model is potentially more complicated than under a harmonised bilateral model, it would also be necessary to introduce an organisation that can function as a central clearing party (CCP). The CCP would simply collect and distribute money associated with any cleared trades. The proposed market operator could take on the CCP function as well, or that could be established in a separate institution.

Primary trading model

Establishing a secondary trading model would fully meet ASEAN’s goal of enabling multilateral power trading among the AMS. It is, however, worth considering a more ambitious, future-oriented option that would bring more benefits to participating countries – albeit with more work required of them.

Under a primary trading model, regional multilateral trading would become the primary mode of trade. All generation in the participating countries would clear in the regional market. This allows for full reserve and capacity sharing, and enables increased optimisation of generation resources across the integrated markets.

Doing so, however, requires that domestic markets be fully restructured. Moreover, under the primary model, there are no national or local markets, but instead only a regional market among the participating countries. Harmonised bilateral trading is still possible under this model, but for the countries involved it would be a replacement for a secondary model.

Functionally, this model is not dramatically different from the secondary model. The role of the regional institutions remains essentially the same, though their overall responsibilities would increase significantly. It would be possible, though, for the same market operator in the secondary model to organise the primary market as well.

In all likelihood, many or perhaps even most of the AMS will choose not to implement a primary model, at least in the near term. This is therefore included as a more future-oriented option, one that could be implemented after the secondary model is established. It is important to note, however, that secondary and primary models are compatible with each other, in the sense that trading is possible between them. In addition, it is still possible for the AMS to utilise the harmonised bilateral trading model.

Conclusion

ASEAN has made significant progress on the development of the APG. Most of this progress, however, has been limited to the bilateral development of transmission infrastructure and trade. Though the ASEAN region is in many respects unique, lessons from international experiences show that it is possible to develop multilateral trading while respecting the local context. Moreover, pilot projects such as the LTMS–PIP demonstrate that it is very possible to establish multilateral trading within ASEAN.

Development of multilateral trading in ASEAN can and should be done in a stepwise and voluntary fashion. It is therefore possible, as demonstrated in Figure 4, that different AMS will choose to participate in different trading models. The proposed trading models allow for that kind of flexibility. Harmonised bilateral trading can benefit all AMS, so long as they are interconnected, by providing a framework and institutional structure to make it more efficient. It may be that a subset of AMS choose to limit themselves to bilateral trading only, while others choose to participate in a secondary model. It may also be that some AMS choose to create a primary trading model among themselves.

Regardless of the path each AMS chooses to take, there are clear benefits to be gained by ASEAN as a whole in moving forward with the establishment of multilateral power trade.

Figure 4. A possible future for power trade in ASEAN

IEA 2019. All rights reserved.